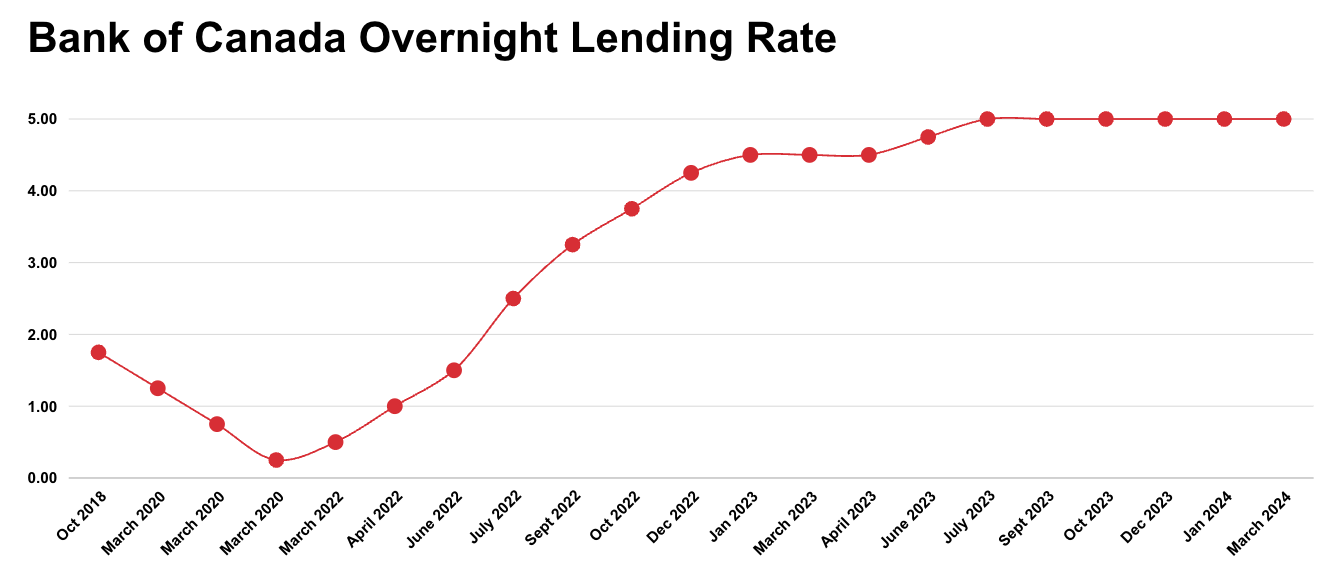

The Bank of Canada has opted to maintain its overnight lending rate at 5% for the fifth consecutive occasion, as announced in its scheduled interest rate declaration on March 6th. It affirmed its commitment to keep the policy rate steady at 5% and to continue the process of normalizing the Bank’s balance sheet.

Despite a drop in the annual inflation rate to 2.9% in January, the Bank cited underlying inflationary factors like shelter costs as grounds for maintaining the current interest rate level. It expressed the desire to witness further easing of inflation and the establishment of price stability before considering rate adjustments.

Economists anticipate potential rate reductions later in the year, possibly in the June announcement, should inflation continue to decrease toward the central bank’s target of 2%. The Bank of Canada's next announcement is scheduled for April 10th, 2024.

Today, the Bank maintained its target for the overnight rate at 5%, with the Bank Rate at 5¼% and the deposit rate at 5%, while also continuing its policy of quantitative tightening.

The global economic landscape saw a slowdown in growth in the fourth quarter, with the US experiencing a slight deceleration but maintaining robust and broad-based GDP growth. Meanwhile, the euro area's economic growth remained stagnant after a contraction in the third quarter. Inflation in both the US and the euro area continued to ease, while bond yields rose and corporate credit spreads narrowed. Equity markets showed strong gains, and global oil prices were slightly higher than previously projected.

In Canada, fourth-quarter GDP growth exceeded expectations, driven by exports, although overall economic growth remained below potential. Despite a modest increase in consumption, final domestic demand contracted, primarily due to a significant decline in business investment. Employment growth continued to lag behind population growth, and there were indications of easing wage pressures. Overall, the data suggest an economy operating with modest excess supply.

CPI inflation eased to 2.9% in January, mainly due to a moderation in goods price inflation. However, shelter price inflation remained elevated and remained the primary contributor to overall inflation. Underlying inflationary pressures persisted, with year-over-year and three-month measures of core inflation remaining in the 3% to 3.5% range. Although the proportion of CPI components growing above 3% declined, it remained above historical averages. The Bank anticipates inflation to stay close to 3% during the first half of the year before gradually easing.

The Governing Council's decision to maintain the policy rate at 5% and continue the normalization of the Bank’s balance sheet reflects concerns about inflation risks, particularly regarding the persistence of underlying inflation. The Council aims to witness further and sustained easing in core inflation while focusing on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behavior. The Bank remains steadfast in its commitment to restoring price stability for Canadians.

.png)