The Bank of Canada today reduced its target for the overnight rate to 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%.

The Canadian economy entered 2025 in a solid position, with inflation close to the 2% target and robust GDP growth. However, heightened trade tensions and tariffs imposed by the United States will likely slow the pace of economic activity and increase inflationary pressures in Canada. The economic outlook continues to be subject to more-than-usual uncertainty because of the rapidly evolving policy landscape.

After a period of solid growth, the US economy looks to have slowed in recent months. US inflation remains slightly above target. Economic growth in the euro zone was modest in late 2024. China’s economy has posted strong gains, supported by government policies. Equity prices have fallen and bond yields have eased on market expectations of weaker North American growth. Oil prices have been volatile and are trading below the assumptions in the Bank’s January Monetary Policy Report (MPR). The Canadian dollar is broadly unchanged against the US dollar but weaker against other currencies.

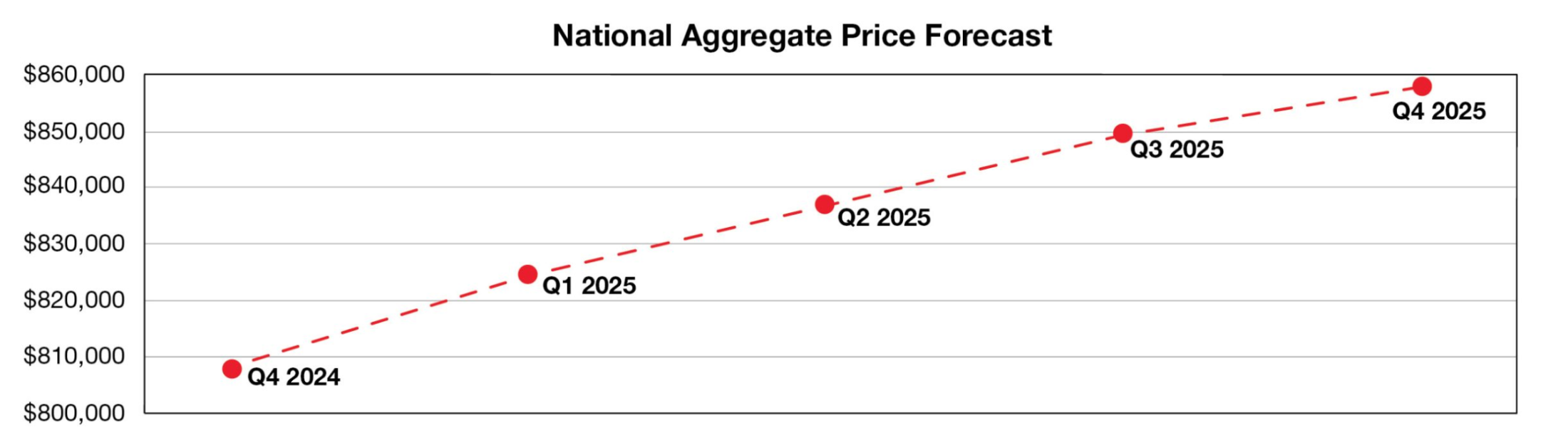

Canada’s economy grew by 2.6% in the fourth quarter of 2024 following upwardly revised growth of 2.2% in the third quarter. This growth path is stronger than was expected at the time of the January MPR. Past cuts to interest rates have boosted economic activity, particularly consumption and housing. However, economic growth in the first quarter of 2025 will likely slow as the intensifying trade conflict weighs on sentiment and activity. Recent surveys suggest a sharp drop in consumer confidence and a slowdown in business spending as companies postpone or cancel investments. The negative impact of slowing domestic demand has been partially offset by a surge in exports in advance of tariffs being imposed.

Employment growth strengthened in November through January and the unemployment rate declined to 6.6%. In February, job growth stalled. While past interest rate cuts have boosted demand for labour in recent months, there are warning signs that heightened trade tensions could disrupt the recovery in the jobs market. Meanwhile, wage growth has shown signs of moderation.

Inflation remains close to the 2% target. The temporary suspension of the GST/HST lowered some consumer prices, but January’s CPI was slightly firmer than expected at 1.9%. Inflation is expected to increase to about 2½% in March with the end of the tax break. The Bank’s preferred measures of core inflation remain above 2%, mainly because of the persistence of shelter price inflation. Short-term inflation expectations have risen in light of fears about the impact of tariffs on prices.

While economic growth has come in stronger than expected, the pervasive uncertainty created by continuously changing US tariff threats is restraining consumers’ spending intentions and businesses’ plans to hire and invest. Against this background, and with inflation close to the 2% target, Governing Council decided to reduce the policy rate by a further 25 basis points.

Monetary policy cannot offset the impacts of a trade war. What it can and must do is ensure that higher prices do not lead to ongoing inflation. Governing Council will be carefully assessing the timing and strength of both the downward pressures on inflation from a weaker economy and the upward pressures on inflation from higher costs. The Council will also be closely monitoring inflation expectations. The Bank is committed to maintaining price stability for Canadians.

Source: www.bankofcanada.ca

.png)