The spring market is gaining momentum in Ottawa, with notable shifts in both buyer and seller behaviour. According to the Ottawa Real Estate Board (OREB), a total of 1,306 homes were sold through the MLS® System in April 2025. While this represents a significant 18.4% increase over March 2025, it also marks an 11.2% decline compared to April 2024.

Sales activity for the month came in 17.6% below the five-year average and 16.2% below the 10-year average, indicating a slower pace when viewed from a longer-term perspective.

“While April sales were down year-over-year, we saw a healthy month-over-month increase—an encouraging sign of growing momentum as we move through the spring market,” says OREB President Paul Czan. “Inventory remains at higher levels compared to previous years, indicating a gradual move towards a balanced market.”

As market conditions shift, both buyers and sellers are adjusting their strategies.

“With more certainty following the federal election, buyers are returning with greater confidence—but they're proceeding cautiously, taking their time, including conditions in their offers, and being more selective,” adds Czan. “Sellers, meanwhile, are adjusting to longer days on market, which makes strategic pricing and thoughtful home preparation more important than ever. If the listing is priced well, shows well, it's moving—and in some cases, it’s even getting multiple offers. Looking ahead, we’ll be watching how the federal government’s recent housing commitments translate into action. Policies aimed at increasing supply, improving affordability, and supporting first-time buyers are welcome steps toward meaningful impact here in Ottawa.”

By the Numbers – Prices

The MLS® Home Price Index (HPI) provides a more accurate reflection of market trends than traditional average or median price measurements.

The overall MLS® HPI composite benchmark price was $631,200 in April 2025 — a 1.1% increase from April 2024.

The benchmark price for single-family homes reached $703,200, rising 1.0% year-over-year.

Townhouses/row units saw a more notable price gain, with a benchmark of $440,000, up 4.4% compared to April 2024.

Apartment-style properties experienced a decline, with the benchmark price at $404,000, down 2.8% from the previous year.

Meanwhile, the average sale price across all property types in April 2025 stood at $707,180, reflecting a modest 0.4% increase compared to April 2024. The total dollar volume of home sales amounted to $923.5 million, which represents a 10.8% decline year-over-year.

By the Numbers – Inventory and New Listings

Market supply continued to expand in April, offering more options for prospective buyers.

New listings totalled 2,589 residential properties, a 3.8% decrease compared to April 2024. However, this figure remains 2.8% above the five-year average and 5.6% above the 10-year average for April.

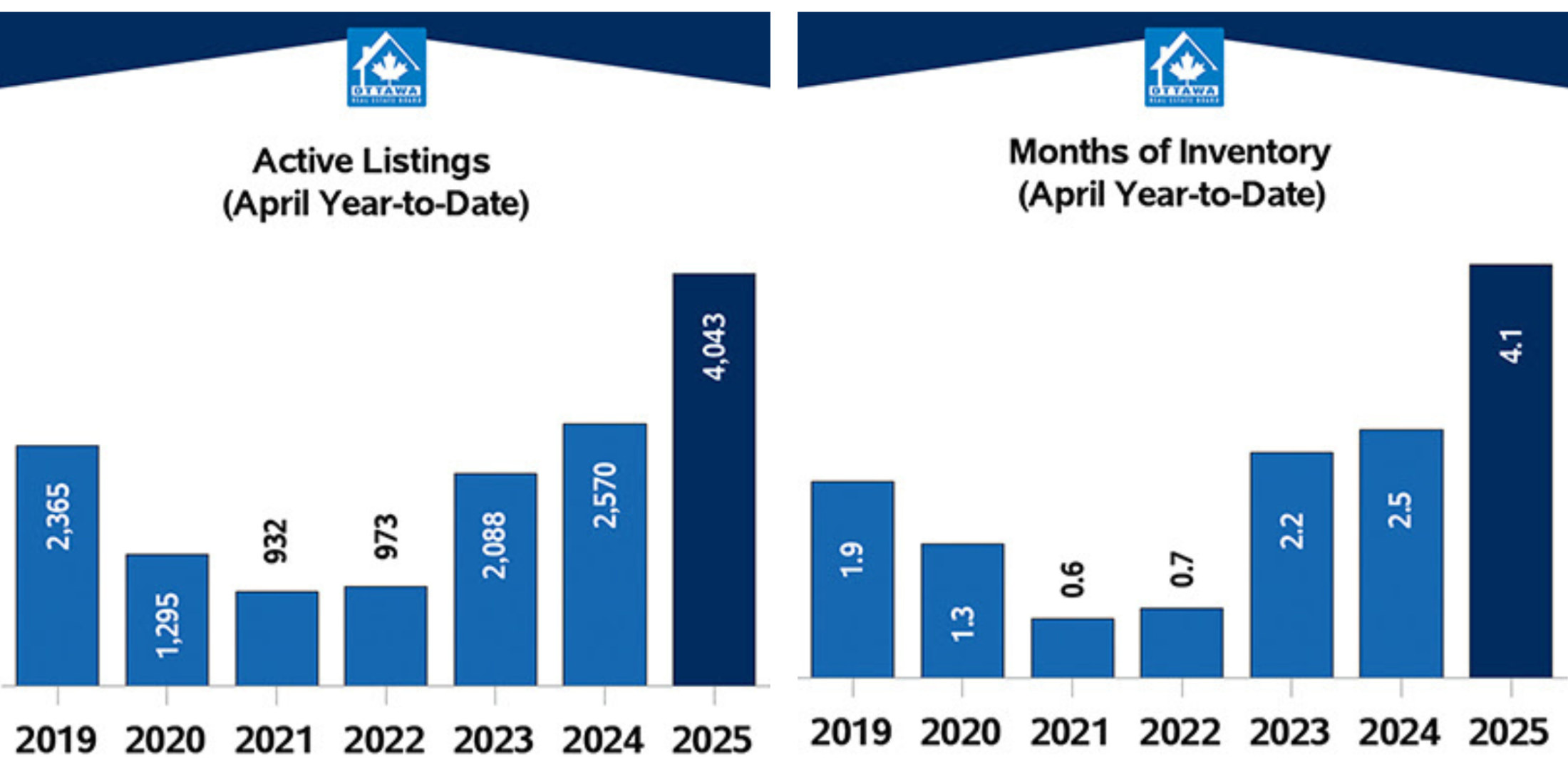

Active listings reached 4,878 units by the end of the month, a surge of 54.2% over last year. Inventory levels were 86.9% higher than the five-year average and 51.3% above the 10-year average.

The months of inventory—which measures how long it would take to sell all current listings at the current sales pace—stood at 3.7, up from 2.2 months in April 2024.

As Ottawa’s real estate market continues its transition toward more balanced conditions, buyers and sellers alike will benefit from working closely with knowledgeable REALTORS® who can help navigate pricing strategies, property preparation, and offer negotiations.

Stay tuned for more insights as we monitor how upcoming policy implementations and evolving market dynamics shape the remainder of the 2025 real estate landscape.

Source:OREB.ca

.png)