A total of 613 homes were sold in December 2024 via the MLS® System of the Ottawa Real Estate Board (OREB), representing a 7.9% increase from December 2023.

Despite this rise, home sales were 6.8% below the five-year average and 2.7% lower than the 10-year average for December. Year-to-date sales reached 13,526 units by December 2024, an 11.8% increase from the same period in 2023.

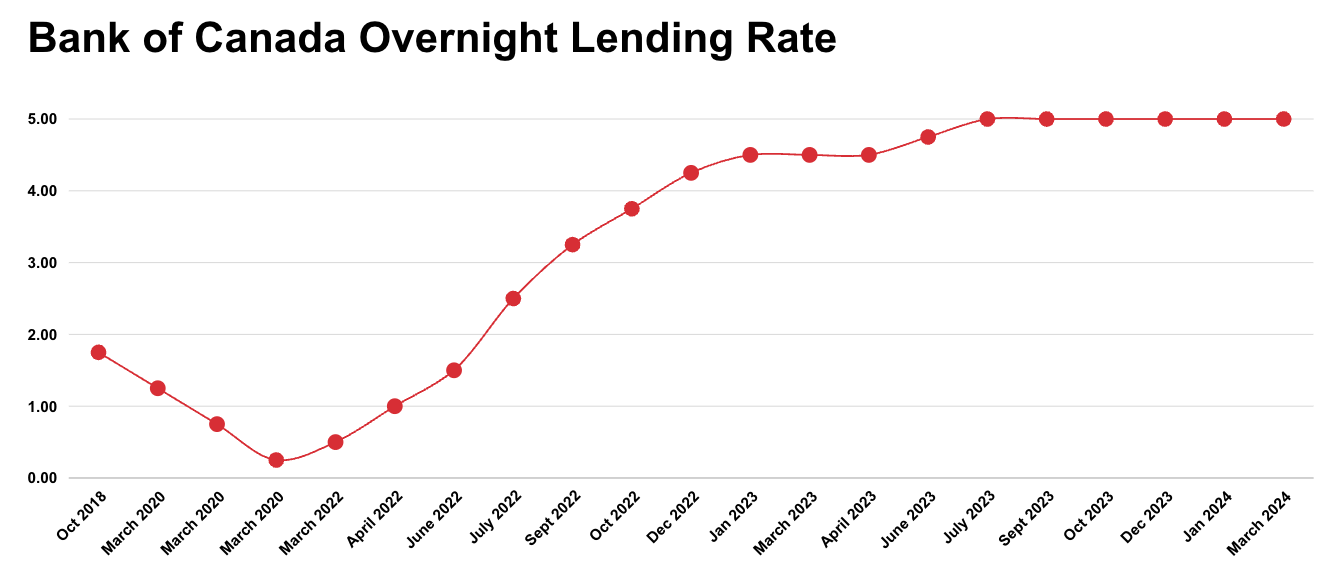

“A year of wait-and-see came to a close with the expected slowdown over the holiday season,” said OREB President Paul Czan. “The latter half of the year brought signs of more favourable market conditions with consecutive interest rate drops, higher insured mortgage limits, and extended amortizations. It’s early to assess the impact of these measures. And it’s an uphill battle against affordability and supply issues that persist.”

“Listing activity indicates that sellers anticipate improved conditions could spur more activity from buyers who have been keeping a close eye on the market but hesitant to make moves. Buyers are still limited in their selection of affordable inventory that can meet current demands, which stalls movement. While the improving market conditions are encouraging, the supply needs to be there. Coming political shifts are adding a layer of uncertainty but there is a trending optimism for more increased market activity in the months ahead.”

By the Numbers – Prices

The MLS® Home Price Index (HPI), which tracks price trends more accurately than average or median prices, highlighted the following:

The overall MLS® HPI composite benchmark price was $645,800 in December 2024, up 3.8% from December 2023.

Single-family homes: $729,300, an increase of 3.7% year-over-year.

Townhouse/row units: $533,200, up 11.3% from a year ago.

Apartments: $404,400, down 2.5% compared to December 2023.

The average sale price in December 2024 was $663,781, a 4.4% increase from December 2023.

Year-to-date, the average price was $679,067, rising 1.3% compared to 2023.

The total dollar volume of home sales in December 2024 was $406.9 million, up 12.7% year-over-year. For the entire year, the total dollar volume reached $9.2 billion, an increase of 13.3% from 2023.

OREB cautions that while average sale prices offer insight into market trends over time, they do not reflect changes in the value of individual properties. Average price calculations are derived from the total dollar volume of all properties sold, with prices varying significantly by neighbourhood.

By the Numbers – Inventory & New Listings

New listings: 603 new residential properties were added in December 2024, marking a 13.6% increase from December 2023. This was 3.5% above the five-year average but 2.7% below the 10-year average for December.

Active listings: Residential listings totalled 3,216 units at the end of December 2024, a surge of 58.7% compared to December 2023. Active listings were 90% above the five-year average and 51.4% above the 10-year average for the month.

Months of inventory: There were 5.2 months of inventory at the end of December 2024, compared to 3.6 months in December 2023. This metric reflects the time it would take to sell all current inventory at the current sales pace.

:max_bytes(150000):strip_icc()/388842512_3c0be15493_o-56a38a1d5f9b58b7d0d27e9f.jpg)

.png)