Ottawa’s housing market continues to demonstrate resilience amid broader economic uncertainty. October brought a modest, seasonal lift in sales activity alongside a decline in the elevated inventory levels seen in recent months—signalling a stable yet cautious phase as we transition into the slower winter period.

A total of 1,177 homes were sold last month, marking an 8.1% increase from September’s 1,089 transactions, though a 1.2% decline year over year compared to October 2024. The average sale price rose to $709,002, up 2.7% month over month and 5.7% higher year over year, suggesting that underlying demand remains healthy despite economic headwinds.

Ottawa recorded 2,405 new listings in October, a 15.1% decrease from September but 13.4% higher than the same month last year. This seasonal dip between September and October has been a consistent trend over the past decade. Meanwhile, active listings fell from 4,388 to 4,232, a 3.6% decline, reflecting the usual autumn adjustment. While inventory remains above levels seen in prior years, this familiar fall decrease indicates that supply is starting to stabilize within a balanced market range.

Reinforcing that balance, the months of inventory eased from 4.0 to 3.6, pointing to a modest tightening between supply and demand as the fall market settled.

The Bank of Canada’s second consecutive rate cut on October 29, 2025, lowered the policy rate by 25 basis points to 2.25%, offering additional relief to borrowers and fueling optimism for an active spring market ahead. However, the Bank cautioned that this move likely marks the final cut in the current cycle.

The Ottawa Real Estate Board (OREB) continues to monitor the recently tabled federal budget and workforce announcements, as fiscal adjustments in these areas often have a direct impact on Ottawa’s market given the city’s significant federal employment base.

Overall, Ottawa’s market remains balanced and fundamentally sound, with measured demand, stable pricing, and a steady performance heading toward year-end.

“Ottawa’s market continues to demonstrate balance and resilience,” said OREB President Paul Czan. “We’re seeing modest growth in sales activity, stable pricing, and a seasonal easing of elevated inventory levels. The recent rate adjustments provide optimism for the coming months, but economic uncertainty looms, and buyers and sellers remain cautious, watching how broader economic factors play out. The current environment points to a steady market rather than a rapid shift in either direction.”

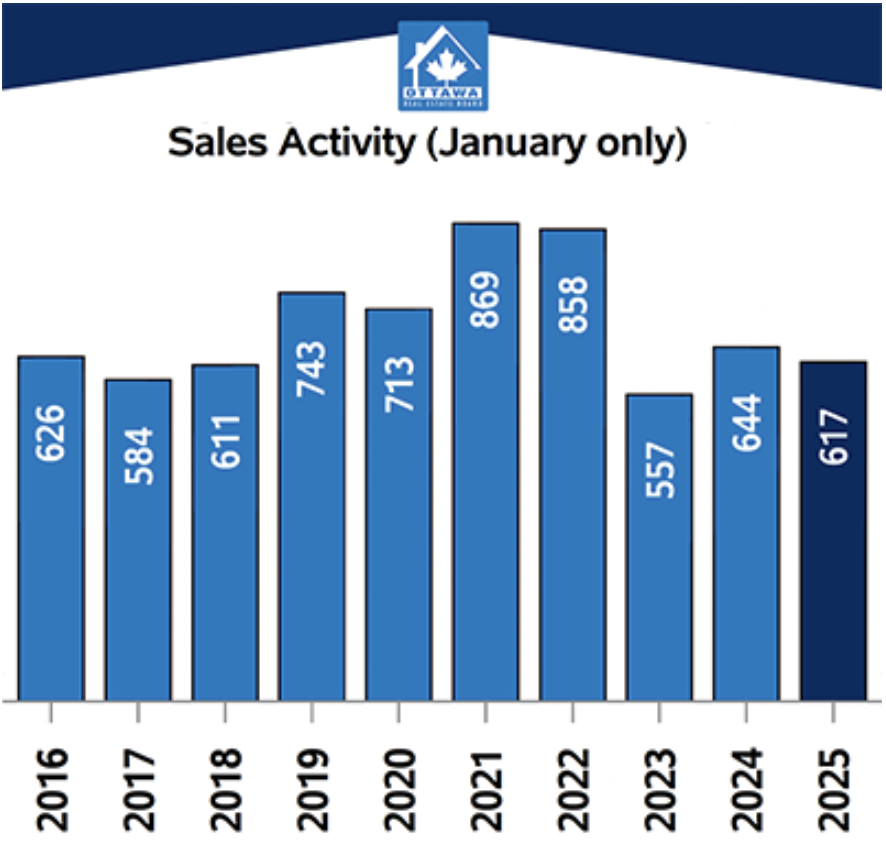

Residential Market Activity

Year to date, 12,197 homes have been sold — a 3.3% increase over the first ten months of 2024. The total dollar volume through October reached $8.55 billion, up 6.5% year over year, while the average year-to-date price sits at $700,869, representing a 3.0% annual increase.

In October alone, the total value of homes sold amounted to $834.5 million, a 4.5% gain compared to last year.

On the supply side, 2,405 new listings entered the market, down 15.1% from September, but still 13.4% higher than October 2024. Active listings totalled 4,232, reflecting a 3.6% month-over-month decrease but 21.3% higher year over year. The months of inventory eased to 3.6, underscoring a slightly tighter yet still balanced market.

MLS® Home Price Index (HPI)

The MLS® Home Price Index composite benchmark for Ottawa was $622,700 in October, down 0.7% month over month but up 0.7% year over year—continuing a trend of moderate, sustainable price movement rather than volatility.

By property category:

Single-Family Homes: $692,400 — up 0.3% from October 2024

Townhomes: $456,300 — up 6.6% year over year

Apartments: $402,900 — up 0.1% year over year

Market Outlook

As the year draws to a close, Ottawa’s housing market stands out for its measured strength and balance. With steady prices, moderating supply, and continued buyer confidence, the capital’s real estate landscape remains well-positioned to navigate the winter slowdown and enter the spring market on solid footing.

Source: OREB.ca

.png)